CHIPS Act – Semiconductor companies seeking U.S. grants under the Chips Act will be asked to provide detailed projections for revenue and profit from their new chip-making plants to help evaluate their applications, the Commerce Department said Monday. The new guideline explains how granular the financial assumptions should be for making projections for revenues, costs and other metrics. Revenue

projection, for example, should include the number of wafers expected to be sold from the facility each month at peak capacity, the expected price for units sold during the first year of production and the annual price increase or decrease expected. The so-called upside profit-sharing provision is

among the most closely watched aspects of the program among industry executives, who worry that high levels of the required profit-sharing could reduce the appeal of receiving government funds to build new facilities.

GaN – Infineon believes the GaN market is at a tipping point, according to Adam White, Infineon’s President of power and sensor systems. Infineon forecasts the GaN market will grow at 56% CAGR through 2027. Infineon recently announced plans to acquire GaN Systems for $830M. Additionally, the company continues to invest in SiC with plans to expand its capacity in Malaysia by spending $2B.

Infineon – Infineon increased its full-year sales outlook and

pre-announced 1QCY upside. Infineon expects 1QCY revenue above €4B vs prior guidance of €3.9B citing resilient demand in core automotive and industrial segments. That combined with positive price and mix and lower energy cots is expected to drive EBIT margins to the high 20%, ahead of prior outlook for

~25%. Infineon also added that now expects FY (Sep) revenue to come “meaningfully” above prior outlook of €15.5B and the positive impacts on margins to apply for the full year.

Micron – China’s Cyberspace Administration, one of the country’s main tech regulators, said on Friday that it is implementing a cybersecurity review of products sold my Micron in China. This comes after warns in its annual filing earlier this week that the Chinese government may restrict it from participating in the China market or may prevent it from competing effectively with Chinese companies.

Samsung – Samsung is considering setting up a chip packaging test line in Japan, according to Reuters, to bolster its advanced packaging business and forge closer ties with Japanese makers of semiconductor equipment and materials.

Samsung – Samsung announced it has spent 200 billion won on initial SiC and GaN device capacity. Reports from Korea suggest Samsung has started shipping prototypes to customers. Samsung is noted as having set a Power Semi team earlier this year as a first step to increase production and participation in SiC and GaN markets. The reports suggest Samsung is planning to manufacture SiC and GaN on a 8 inch wafers, skipping the entry 6 inch level,

Semis – The United States and Canada said on Friday they would work together to create a bilateral semiconductor manufacturing corridor to reduce dependence on other countries for critical minerals and semiconductors. As a result of the agreement the Canadian government announced will spend C$250 million ($181.94 million) on its domestic semiconductor industry to boost research and development

and manufacturing.

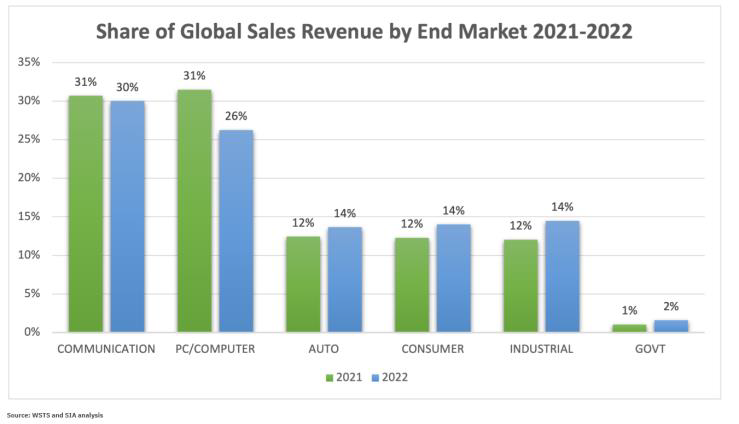

Semi sales – SIA’s final sales data for 2022 shows Automotive, Industrial and Consumer sales increased as percent of total semi sales with each accounting for 14%, up from 12% in 2021. Conversely, PC/Compute sales declined as percent of total to 26% from 31% in 2021 and Comm sales dipped to 30% from 31% in 2021.

Semi materials – Chipmakers are joining forces with industrial material businesses to fight state legislation on restricting PFAS usage, a chemical used in semiconduction production among other things. More than 30 US states this year are considering legislation to address PFAS, according to Safer States, an environmental advocacy group. Bills in California and Maine passed in 2022 and 2021, respectively. The effort to restrict PFAS usage comes after studies say long-term PFAS exposure

can weaken immune systems, decrease infant and foetal growth and increase kidney cancer risk in adults, according to a 2022 report by the US National Academies of Sciences, Engineering and Medicine. Semi companies are, in turn, arguing there are no alternatives to PFAS in semi manufacturing and new state rules risk a significant increase in cost of semi production, which will likely be based on to consumers in higher prices. Separate reports suggest the EU is also considering a ban on PFAS use. However, depending on the industry, a grace period of up to 18 months to 12 years will be allowed until substitute materials are developed.

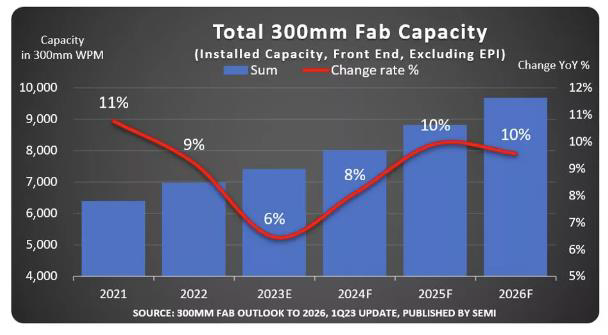

Semi capacity – Global 300mm semi fab capacity is forecasted to grow at 8% CAGR from 2023 to 2026 reaching 9.6 million wafers starts per month, according to the latest data from SEMI. In 2023 fab capacity growth is forecasted to slow to +6%, from +9% in 2022, due to weaker memory and logic demand but accelerate to +8% and +10% in 2024 and 2025/26 driven by 30% CAGR growth in analog and power semi capacity. Regionally, China share of global capacity is forecasted to increase from 22% in 2022 to 25% in 2026 with increasing focus on mature technologies, Korea, Taiwan and Japan share is forecasted to decline, while N.A. and Europe are projected to increase as a percent of global capacity.

Semi Equipment – Japan said on Friday it will restrict exports of 23 types of semiconductor manufacturing equipment, aligning its technology trade controls with a U.S. push to curb China’s ability to make advanced chips. Japan did not specify China as the target of the restrictions, saying manufacturers would need to seek export permission for all regions. Effective July, Japan will impose export controls on six categories of equipment used in chip manufacturing, including cleaning, deposition, lithography and etching.

TSMC – Despite a recent increase in orders from Nvidia, TSMC continues to experience incremental cuts in orders from major customers such as MediaTek and Apple, according to reports from Asia. The reports state that fabless customers have cut orders for 2Q more than expected and TSCM utilization will

continue to decline.

TSMC – According to reports from Asia, Liu Deyin, the chairman of TSMC, has stated for the first time that TSMC could not accept some of the restrictions imposed by the US CHIPS Act, without providing further context. Mr. Liu Deyin spoke to a media event saying that he believes US and Taiwan can reach a

compromise that won’t impact TSMC negatively.

WDC/Kioxia – Western Digital and Kioxia announced it has started sample shipments of its next-gen NAND technology based on 218 layers and 1Tb TLC and QLC

Source from: Edgewater Research