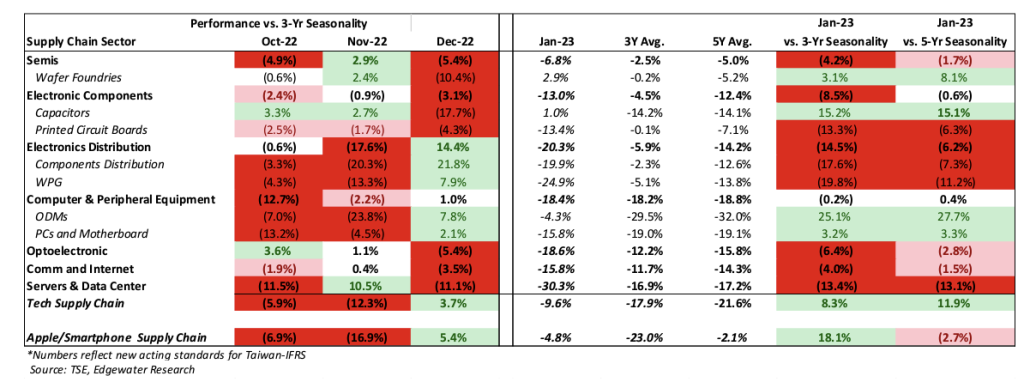

Taiwan Tech Supply Chain: January sales skewed by Foxconn; mostly below seasonal Key Takeaways:

1. Taiwan tech supply chain sales in January declined 10% M/M, or 9-11 points better than seasonality adjusted for Jan CNY.

2. Aggregate sales were stronger due to a recovery/catch up in Foxconn operations/sales (36 points stronger than seasonal) following the COVID and protests in China’s largest factory producing high-end iPhones. Excluding the impact of Foxconn sales Tech sales were largely seasonal.

3. On a y/y basis, Taiwan tech supply chain sales declined 2% in Jan, compared to -9% in Dec and -7% in Nov and positive double digit growth through most of 2022. Excluding the abnormal sales at Foxconn, Jan sales would have been down 12% y/y.

4. By category, distribution, PCB, electronics component, semis and server and data center missed seasonality while foundry, led by TSMC, capacitors, Foxconn were better than seasonal.

5. Semis sales declined 7% m/m, or 2-4 points below seasonality. Semi sales have now been weaker than seasonal 5 times in the last 6 months. Notably, semi sales declined y/y (down 9%) for the first time since Oct 19.